2025 Mein Best Insurance Plan Ka Chunav Kaise Karein? – Ek Puri Guide

Insurance sirf ek policy nahi, balki ek financial safety net hai jo mushkil samay mein aapko aur aapke parivaar ko suraksha deta hai. 2025 mein, insurance plans aur companies ne kai naye features aur customer-friendly options introduce kiye hain, jo aapke liye chunav ko thoda mushkil bana sakte hain. Is article mein hum aapko batayenge ki 2025 ka best insurance plan kaun sa hai, aur aap apne liye perfect policy kaise chunein.

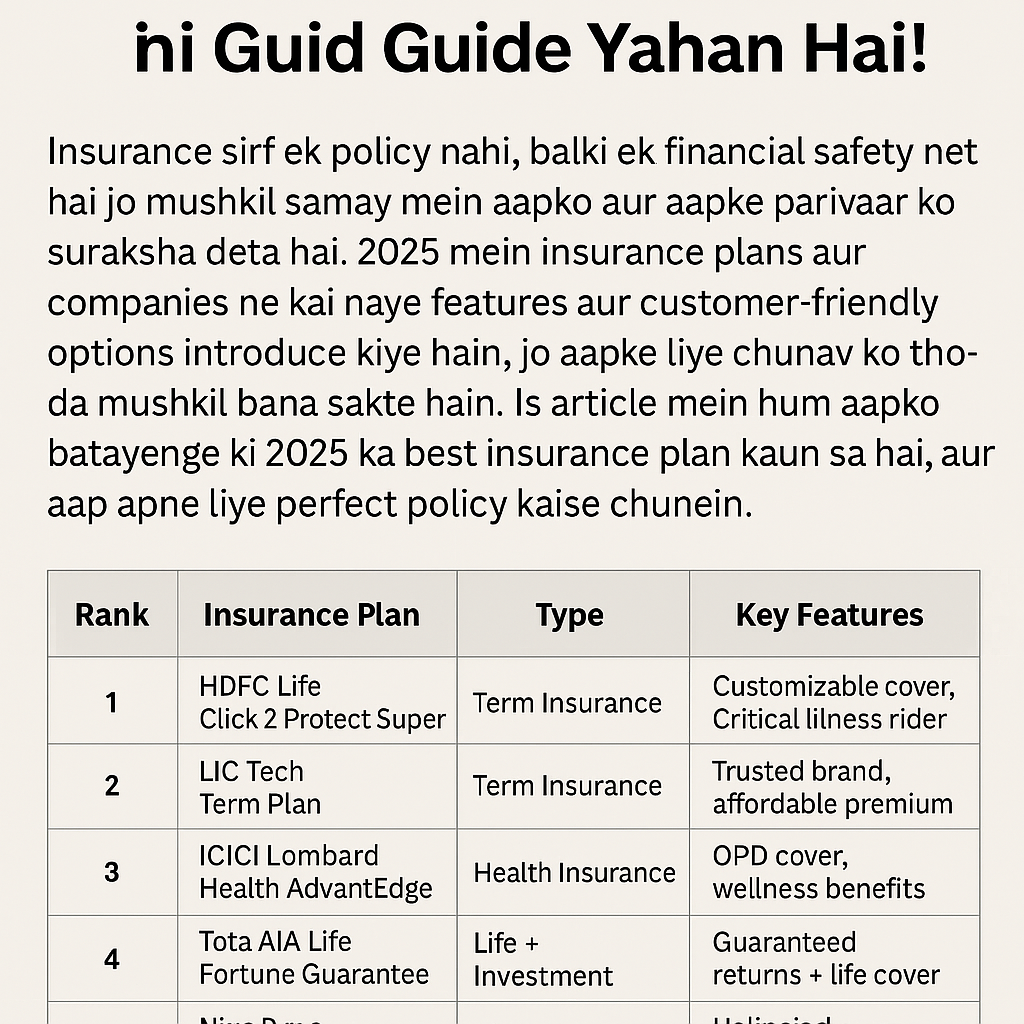

✅ 2025 ke Top Insurance Plans – Ek Nazar Mein

| Rank | Insurance Plan | Type | Key Features | Ideal For |

|---|---|---|---|---|

| 1 | HDFC Life Click 2 Protect Super | Term Insurance | Customizable cover, Critical illness rider | Working Professionals |

| 2 | LIC Tech Term Plan | Term Insurance | Trusted brand, affordable premium | Middle-income earners |

| 3 | ICICI Lombard Health AdvantEdge | Health Insurance | OPD cover, wellness benefits | Families & Individuals |

| 4 | Tata AIA Life Fortune Guarantee Plus | Life + Investment | Guaranteed returns + life cover | Long-term savers |

| 5 | Niva Bupa ReAssure 2.0 | Health Insurance | Unlimited reinstatement, booster benefits | Senior citizens |

🔍 Insurance Choose Karne Se Pehle In Baaton Ka Dhyan Dein

- Coverage Amount (Sum Assured) – Aapki income aur financial responsibilities ke hisaab se sum assured choose karein.

- Premium Affordability – Har mahine ya saal bharne waale premium aapke budget mein fit hone chahiye.

- Claim Settlement Ratio – Company ka claim settle karne ka record strong ho (90% se upar ho).

- Add-on Riders – Critical illness, accidental death, disability jaise riders useful ho sakte hain.

- Policy Term – Policy ka duration aapke financial goals se match karein.

🧠 Term Insurance vs Health Insurance vs ULIPs – Kya Fark Hai?

| Feature | Term Insurance | Health Insurance | ULIP (Investment + Insurance) |

|---|---|---|---|

| Purpose | Death benefit | Medical expenses cover | Wealth creation + Life cover |

| Returns | Nahi (pure protection) | Nahi | Market-linked returns |

| Ideal for | Family protection | Hospitalization needs | Long-term investment goals |

🏆 Best Overall Plan of 2025 – HDFC Life Click 2 Protect Super

HDFC Life ne apni Click 2 Protect Super policy ke saath market mein sabse flexible aur personalized insurance plan offer kiya hai. Yeh policy aapki needs ke hisaab se cover, riders aur premium adjust karne ki suvidha deti hai. Critical illness, waiver of premium aur accidental death rider jaise options ke saath yeh plan 2025 ka best term insurance ban gaya hai.

💡 Pro Tips: Insurance Lete Waqt In Galtiyon Se Bachein

- Sirf premium kam dekhkar policy na lein – cover aur claim settlement bhi dekhein.

- Apne health ya smoking status ko galat na batayein – claim reject ho sakta hai.

- Kabhi bhi policy documents padhe bina sign na karein.

📝 Conclusion

2025 mein insurance lena ek smart financial decision hai, lekin sahi plan ka chunav aur bhi important hai. Chahe aap apne parivaar ke liye security dhoond rahe ho, ya apne liye health ya investment policy, upar diye gaye options aur tips aapko best insurance plan choose karne mein madad karenge.

“2025 Ka Best Insurance Plan Kaun Sa Hai? Puri Guide Yahan Hai!”

“Top 5 Best Insurance Plans in India for 2025 – Compare & Choose Smartly!”

“Insurance Plan 2025: Kaise Chune Apne Liye Best Policy?”

“2025 Mein Sabse Behtar Insurance Policy – Expert Analysis & Tips”

“Best Insurance Plans in 2025 – Health, Life & Investment Options Explained”

/best-insurance-plan-2025-india

/top-insurance-policies-2025

/how-to-choose-best-insurance-2025

/2025-insurance-comparison-guide

/best-health-life-insurance-2025

Tags : best insurance plan 2025, insurance plans in India 2025, top insurance policy 2025, health insurance 2025 India, life insurance plans 2025, which insurance plan is best in 2025, best term insurance plan in India 2025, top health insurance companies 2025, affordable insurance policy India, insurance plan comparison 2025, claim settlement ratio 2025, critical illness rider insurance, insurance premium calculator 2025, LIC vs HDFC term plan 2025, tax benefits on insurance in 2025,